Our Tulsa Bankruptcy Attorney Diaries

Our Tulsa Bankruptcy Attorney Diaries

Blog Article

Some Ideas on Tulsa Bankruptcy Lawyer You Need To Know

People need to use Phase 11 when their financial debts exceed Phase 13 financial debt limitations. Phase 12 bankruptcy is developed for farmers and anglers. Chapter 12 payment plans can be extra versatile in Chapter 13.

The means examination considers your typical regular monthly earnings for the 6 months preceding your filing day and compares it versus the typical income for a similar family in your state. If your income is listed below the state average, you instantly pass and do not need to complete the entire type.

If you are wed, you can file for bankruptcy jointly with your spouse or individually.

Filing insolvency can aid an individual by throwing out financial obligation or making a strategy to pay off debts. A personal bankruptcy case normally starts when the debtor submits a request with the personal bankruptcy court. A request may be submitted by an individual, by spouses together, or by a firm or various other entity. All personal bankruptcy instances are managed in government courts under rules described in the U.S

Filing insolvency can aid an individual by throwing out financial obligation or making a strategy to pay off debts. A personal bankruptcy case normally starts when the debtor submits a request with the personal bankruptcy court. A request may be submitted by an individual, by spouses together, or by a firm or various other entity. All personal bankruptcy instances are managed in government courts under rules described in the U.SThe Buzz on Bankruptcy Attorney Tulsa

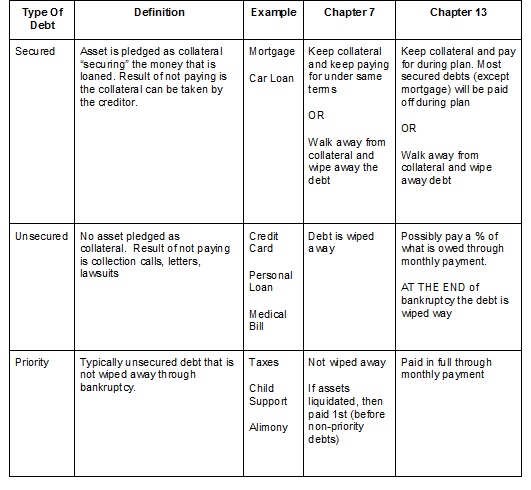

There are different kinds of bankruptcies, which are usually described by their chapter in the united state Personal Bankruptcy Code. Individuals may file Phase 7 or Phase 13 insolvency, depending on the specifics of their situation. Municipalitiescities, communities, towns, tiring districts, municipal energies, and institution districts may submit under Chapter 9 to reorganize.

If you are dealing with financial obstacles in your personal life or in your organization, chances are the concept of declaring personal bankruptcy has crossed your mind. If it has, it additionally makes good sense that you have a whole lot of bankruptcy inquiries that need solutions. Numerous individuals actually can not respond to the inquiry "what is bankruptcy" in anything except basic terms.

Several individuals do not understand that there are numerous kinds of personal bankruptcy, such as Phase 7, Phase 11 and Chapter 13. Each has its benefits and challenges, so knowing which is the most effective alternative for your existing circumstance in addition to your future recovery can make all the difference in your life.

Chapter 7 is termed the liquidation insolvency chapter. In a chapter 7 insolvency you can get rid of, clean out or release most sorts of financial debt. Instances of unsecured debt that can be eliminated are charge card and medical expenses. All types of individuals and firms-- people, couples, corporations and partnerships can all file a Phase 7 insolvency if eligible.

Not known Factual Statements About Chapter 7 - Bankruptcy Basics

Lots of Chapter 7 filers do not have much in the method of properties. Others have homes that do not have much equity or are in serious demand of fixing.

The quantity paid and the period of the plan relies on the debtor's building, median income and costs. Lenders are not enabled to go after or preserve any type of collection activities or suits during the case. If effective, these lenders will certainly be erased or discharged. A Phase 13 bankruptcy is really powerful due to the fact that it supplies a system for borrowers to avoid repossessions and sheriff sales and stop foreclosures and energy shutoffs while catching up on their protected financial obligation.

A Chapter 13 situation may be helpful because the debtor is permitted to get captured up on mortgages or vehicle loan without the danger of foreclosure or foreclosure and is permitted to keep both excluded and nonexempt residential property. Tulsa OK bankruptcy attorney. The borrower's plan is a paper outlining to the insolvency court just how the debtor recommends to pay present costs while settling all the old debt equilibriums

It gives the debtor the possibility to either market the home or end up being caught up on home mortgage settlements that have actually fallen back. A person submitting a Phase 13 can propose a 60-month plan to heal or end up being current on home mortgage repayments. For example, if you fell back on $60,000 well worth of home loan repayments, you could recommend a plan of $1,000 a month for 60 months to bring those home mortgage settlements present.

It gives the debtor the possibility to either market the home or end up being caught up on home mortgage settlements that have actually fallen back. A person submitting a Phase 13 can propose a 60-month plan to heal or end up being current on home mortgage repayments. For example, if you fell back on $60,000 well worth of home loan repayments, you could recommend a plan of $1,000 a month for 60 months to bring those home mortgage settlements present.The Best Strategy To Use For Top Tulsa Bankruptcy Lawyers

Occasionally it is better to prevent personal bankruptcy and settle with lenders out of court. New Jacket additionally has an alternative to insolvency for organizations called an Assignment for the Benefit of Creditors (bankruptcy lawyer Tulsa) and our legislation company will certainly look at this alternative if it fits as a potential technique for your service

We have actually produced a device that assists you select what phase your documents is more than likely to be submitted under. Visit this site to use ScuraSmart and figure out a possible service for your financial obligation. Lots of individuals do not recognize that there are a number of types of insolvency, such as Chapter 7, Chapter 11 and Phase 13.

The Only Guide to Top Tulsa Bankruptcy Lawyers

Below at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we manage all sorts of bankruptcy situations, so we are able to address your insolvency concerns and aid you make the very best decision for your instance. Right here is a quick look at the financial obligation alleviation choices available:.

You can only file for personal bankruptcy Before declaring for Chapter 7, at least one of these need to be true: You have pop over to this website a lot of financial debt earnings and/or assets a lender can take. You have a whole lot of debt close to the homestead exception quantity of in your home.

Hanson & Hanson Law Firm, PLLC

Address: 4527 E 91st St, Tulsa, OK 74137, United StatesPhone: +19184090634

Click here to learn more

Report this page